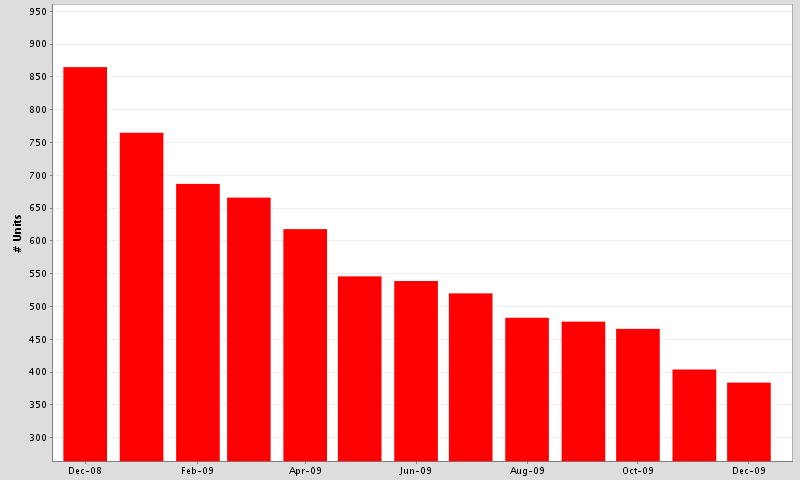

From December 2008, the number of homes for sale is down 56%, from 865 to 384 properties offered for sale. Keep in mind that we still had bidding wars in 2008. Average days on market is also down from 85 to 47. Overall, due to interest rates and the first time home buyer credit, it is an excellent time to buy. Our local market in Santa Maria and Orcutt is competitive though and buyers should be prepared for a bit of hurry up and wait to find the perfect home. If you are interested in buying or selling and need a Realtor in Santa Maria, call me today at (805) 878-9879. I will be happy to provide even more information to you about the Santa Maria and Orcutt market at our initial consultation.

Tni LeBlanc, JD, M.A., e-PRO

Tni LeBlanc, JD, M.A., e-PRO

Broker/Owner, Mint Properties

(805) 878-9879, tni@MintProp.com

www.iLoveSantaMaria.com

www.SellMySantaMariaHome.com

www.BuySantaMariaForeclosures.com

www.SantaMariaRealEstateSearch.com

*Based on the information from the Central Coast Regional MLS. Neither the Association, the Multiple Listing Service, or Mint Properties guarantees or is in any way responsible for its accuracy. Data maintained by the Association or its MLS may not reflect all real estate activity in the market.